Hi Quartz members!

It’s always good to avoid a worst-case scenario. As the US Federal Reserve hiked interest rates, inflation has fallen steadily since its peak in June 2022, while the labor market has only strengthened. Despite challenges for small banks and mixed signals from surveys of economic activity, the fabled “soft landing”—a period of disinflation without a recession—is still within reach.

But for our sins, the US government is now about to run into its debt ceiling—an arbitrary limit on new borrowing—in early June.

If the US can’t borrow, it can’t pay its bills, particularly its interest payments. A default on US government debt would be catastrophic for the US and the global economy. Even a short disruption would likely lead to market crashes; a serious default would create a massive worldwide recession (pdf).

The US is carrying a lot of debt after the fiscal stimulus delivered during the pandemic, and a balanced deficit reduction plan wouldn’t hurt. The White House has proposed $3 trillion in spending cuts and tax increases over the next decade. But Republicans in the House of Representatives are threatening to cause a default if the government doesn’t agree to $4.8 trillion in cuts. It’s hard to take them seriously, given their own history of fiscal profligacy; the Trump administration, for one, added a massive $7.8 trillion to the US debt. But if the Republicans don’t come to a compromise, the US will hurtle towards a breach of its debt ceiling, with severe consequences for its economy.

And when the US stumbles, the global economy does too. US debt is the foundation of global financial markets, and its currency remains the foremost medium of exchange. This isn’t the time to jolt international markets. Europe still faces energy challenges from Russia’s invasion of Ukraine, relations between the US and China are at a 21st century nadir, and developing nations around the world have seen their economies suffer from both inflation and the Fed’s tightening.

It’s a particularly awful moment to start a debt crisis for the sole reason of avoiding one in the future. “Clearly, distress in the world’s biggest economy would be negative for everyone,” World Bank president David Malpass told Reuters yesterday (May 12). “The repercussions would be bad.”

But in the real world, the 2024 election and the GOP’s MAGA wing make a straightforward deal unlikely. President Joe Biden has insisted that he won’t negotiate to lift the debt ceiling, which may mean that the best way to resolve this impasse is boldness: citing the Constitution to ignore contradictory instructions from Congress, or minting a platinum coin to pay US debt. For years, policymakers have considered these ideas too outlandish. But what’s worse: a crisis or a gimmick?

IS THERE REALLY A DEBT CRISIS?

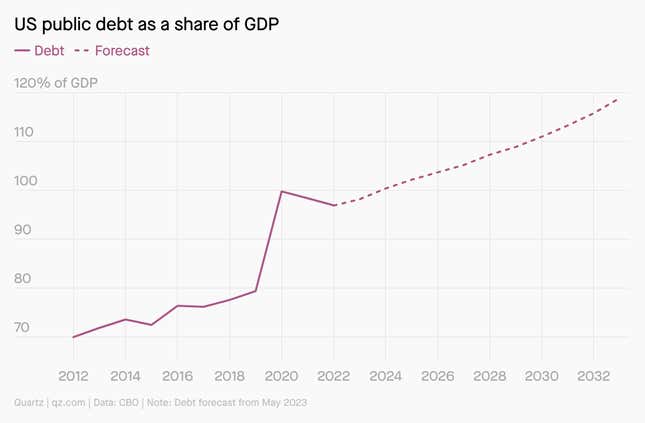

Short answer: No. The wealthiest nation in the world isn’t even close to losing the ability to finance its borrowing (which is really the definition of a debt crisis). But especially after pandemic outlays, US debt equaling roughly a year’s worth of economic production makes many economists nervous.

It shouldn’t necessarily, as the counter-example of Japan suggests. Per the IMF, Japan has a debt-to-GDP ratio of around 260%, but it has not had to suffer an onerous interest payment burden or any other economic horrors. (That may change if rates keep rising, of course.) In comparison, the US’s ratio is only projected to rise from around 97% to near 120% by the early 2030s.

THE EXPENSIVE DEBT-CEILING STANDOFF

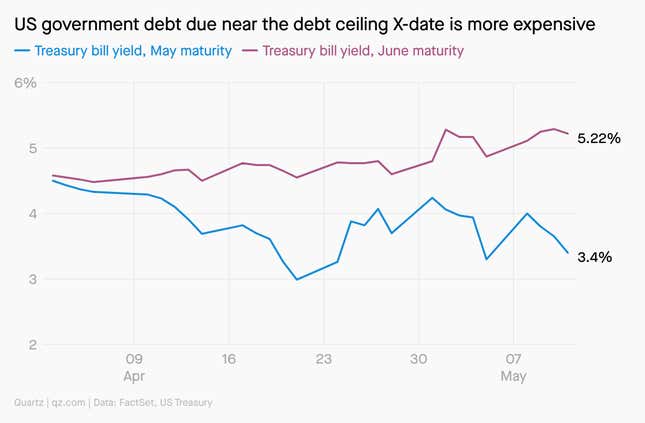

While Wall Street types tend to be (too) sanguine about the possibility of politicians reaching a deal, that calm stance is starting to slip: Investors are forcing the government to pay higher interest rates on debt due when the US is predicted to hit its debt ceiling, known as the X-date.

Short-term government debt due in mid-June is currently paying yields more than 100 basis points higher than debt due in mid-May. That’s a huge spread between two bills that should be priced similarly, with just a month between their maturity dates—except if you think there’s risk of a default, or simply a market crash linked to potentially chaotic negotiations.

🎧 Podcast interlude

In our current season of the Quartz Obsession podcast, host Scott Nover has been exploring the ways tech can change our lives, for better or for worse. Last week’s episodes dive into two areas where tech is making great strides—except where it’s come to a screeching halt.

Quartz’s tech and breaking news reporter Ananya Bhattacharya chronicles the rise of WeChat in China, while also observing the West’s fervent, and possibly doomed, attempts to come up with its own superapps. Meanwhile, as generative AIs like ChatGPT flood our internet, Quartz’s emerging tech reporter Michelle Cheng is fascinated by what this powerful technology confidently gets wrong.

Listen to “Superapps: There can be only one” and “AI hallucinations: Turn on, tune in, beep boop.” Tune in next week for our reporters’ and editors’ takes on the technology that thinks it can solve single-use plastic and online voting.

✅ Subscribe wherever you get your podcasts: Apple Podcasts | Spotify | Google | Stitcher | YouTube

ONE 💲 THING

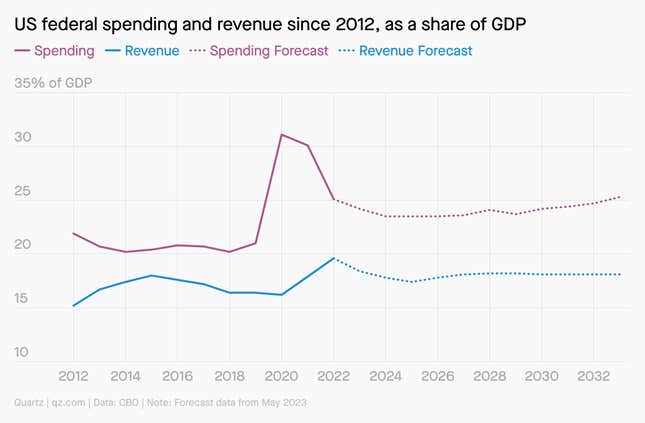

In all this kerfuffle, the real issue is the mismatch between outlays and revenue:

The White House wants to narrow this gap by cutting spending and raising taxes equal to about $3 trillion over 10 years. Republicans propose mainly to cut spending alone by $4.8 trillion through arbitrary spending limits—and those caps typically get thrown out the window a few years down the line. Another part of the problem is that Republicans don’t want to raise taxes or cut spending on defense, border security, or veteran’s programs. They also want to cut IRS funding that would enable the agency to go after tax cheats and recover tax revenues. That means they have to apply draconian cuts to the remaining 14% of the budget to reach their goals—and it’s not clear that’s politically possible.

We’ve got good news!

Our members love the Weekend Brief, so we’ve decided to send you not one but two emails each weekend.

“Weekend Brief: Sunday Reads” will feature the 5 Stories from Elsewhere you know and love, plus more Quartz editor picks, and some information that will help start your week in the know.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Have a crisis-free weekend,

— Tim Fernholz, senior reporter

0 Comments :

Post a Comment