Despite all the negativity and downturns in the crypto space, NFT floor prices are painting a different story entirely. In the last few weeks, NFTs have seen a massive change of hands, with experienced traders selling off NFTs to free up liquidity and new buyers flooding into the market. Are NFTs leading crypto on to the next bull run? Read on to learn more about what’s happening in the space.

What’s Up With NFT Floor Prices?

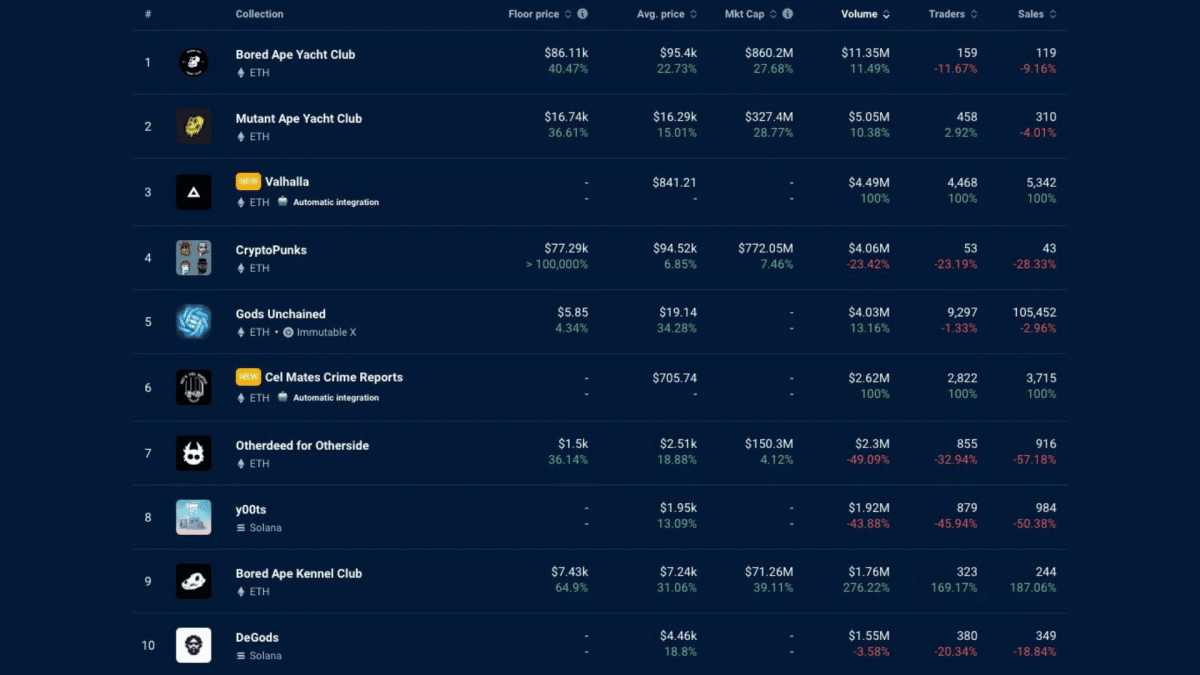

This week saw a rise in floor prices across the board among different top NFT projects. In addition to floor prices, trading volumes and average sale prices are also on the rise. The 7-day metrics for top projects including the likes of BAYC, MAYC, Otherside, BAKC, and other projects are consistently above 30%! Below is a 7-day metric chart for the NFT projects:

According to the data, the top 10 NFT projects across the Ethereum ecosystems are experiencing upticks in market cap as well as trading volume. It also includes newer collections on Ethereum such as Valhalla and Cel Mates. Although there is no single chain of events that have led to the rise of NFT trades, a few indicators can dictate why this might be so. The first of which is the upward momentum of the price of ETH, bringing in liquidity to the market. Moreover, there has also been a 7.5% uptick in the price of WETH, suggesting more NFT trades and flips happening at marketplaces. This could also be due to the 0% fees adopted by NFT marketplaces. Every flip adds a new rise to the price, owing to newer profits made. The table above suggests this is exactly what’s happening across the board.

According to crypto analyst @punk9059, in the last 7 days, total 63% of BAYC/MAYC/BAKC trades were unique NFT trades. Leading to the lowest percentage ratio of Unique NFTs vs Total Trades. This essentially means short-term flips are at an all time high. Which also means the whales up there are raking in profits during the long bear market. These cumulative actions can be attributed to the rising NFT floor prices.

A Rising Horizon?

Furthermore, last week’s panic selling and price drop activity may indicate that this was the bottom for many collections. That panic was ofcourse, fueled by the FTX fiasco and forced many top NFT holders to liquidate into stable assets. This in turn led to a mass influx of new buyers in to the market, leading to rising prices. Whatever the case may be, NFTs are leading the charge in the bear. Two Bored-Ape’s sold for about $1 million USD in the last week. Meanwhile, a CryptoPunk Punk 7261 sold for over $300,000 belonging to Punks OTC. The Punks OTC account holds over 60 Punks!

Join Our New “To The Moon” daily Newsletter

Get our free, 5 minutes daily newsletter. Join 25,000+ NFT enthusiasts & stay on top 👊🌚

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.

Vineet

Vineet is a storyteller based in Mumbai. Having previously worked for various web2 organizations as a journalist, instructional designer, and event manager, he got into blockchain in early 2021. As a musician by passion, he fell in love with the digital megastructures building the future of art and creativity. He believes that web3 unlocks creativity at a higher level, and works towards onboarding music projects to the space.

0 Comments :

Post a Comment