You are here: Home/ News/ Ripple CEO Compares FTX’s Fraud To Wells Fargo’s Funds Mismanagement

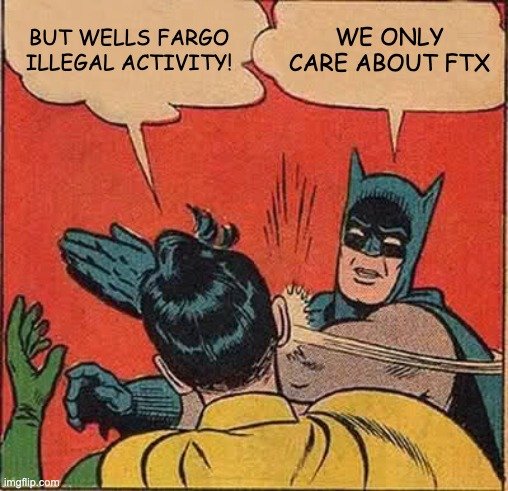

During the feverish FTX turmoil news cycle, Ripple CEO Brad Garlinghouse weighs in with a new comparison, FTX’s fraud with Wells Fargo funds mismanagement.

The world is (appropriately) outraged by SBF and FTX’s fraud, but when Wells Fargo mismanages billions in customer funds as well, it’s barely a blip on the radar. Food for thought…. https://t.co/uHnumn4Ryi

Brad tweeted that although SBF and FTX’s fraud has rightfully outraged the globe, it hardly registers on the news when Wells Fargo mismanages billions of dollars in consumer assets.

Where the local community also contributes their views. The majority contends that it is accurate to say that the public has been deeply outraged and reacting negatively to the recent activities of SBF and FTX. It is also true that Wells Fargo’s improper handling of billions of dollars in client cash has not drawn as much attention.

It poses the issue of why certain financial scandals draw more attention than others. It could be a result of the seriousness of the crime, the perceived effect on certain customers, or the volume of media attention.

Some argue that the customer effect from FTX was quick and direct. Even while bank fraud affects consumers, most of the time, consumers are not aware of it.

@bgarlinghouse @FTX_Official directly impacted customers and the impact was immediate. Banks fraud while effects customers their impact is not immediate and most the times isn’t felt by customers.

Wells Fargo routinely charged its clients’ inaccurate fees and interest rates on car and home loans, illegal surprise overdraft fees, and improper charges to checking and savings accounts over the course of several years. By which 16 million clients are impacted.

As a result of the Wells Fargo crisis, which broke out in 2016, the bank’s treatment of its clients and workers came under scrutiny. It led to congressional hearings, a plethora of regulatory investigations, and the final resignation of two of the bank’s CEOs.

Wells Fargo & FTX Current Status

Wells Fargo Bank is being penalized by the CFPB with a $1.7 billion civil fine and more than $2 billion in consumer restitution for breaking the law across many of its primary product lines.

CNBC reported yesterday that the bank also agreed to pay a civil penalty of $1.7 billion. According to the bank’s spokesman:

We have already communicated with many of the customers who may have been impacted by the matters covered in the settlement, and those efforts are ongoing.

However, in the case of FTX, two Sam Bankman-enterprises officials, Fried’s Caroline Ellison and Zixiao Gary Wang have pleaded guilty to federal charges. US Attorney Damian Williams of the Southern District of New York announced it late on Wednesday.

Statement of U.S. Attorney Damian Williams on U.S. v. Samuel Bankman-Fried, Caroline Ellison, and Gary Wang https://t.co/u1y4cs3Koz

The two pled guilty to crimes relating to their insider status at FTX and its sister business Alameda Research, according to the attorney, who did not disclose the specific charges the two pleaded to.

Related Reading | Crypto presales for a 100X Gain in 2023: Rate That Crypto, RobotEra, and SmarterWorx

0 Comments :

Post a Comment