Online News Magazine

Here is what you need to know on Wednesday, November 30:

The last day of the month often sees some contraflow moves, but more so when it is the end of the quarter. Nonetheless, this month has seen the US Dollar lower and equities higher, so it is worth bearing in mind as we approach the close. All eyes will be on Powell as nothing much is happening beforehand. China continues to open up, but the expected follow-through yesterday did not materialize. Equities were mostly flat apart from tech dropping and energy rising. Today we already have conflicting data from the US. ADP reports weak job growth, while US GDP comes in strong. Really we will just have to wait for Powell. I expect him to be hawkish.

The Dollar Index has dropped to 106.50, while Gold is higher at $1,757 as yields fall. Oil is still recovering to $81, and Bitcoin has risen to $16,800.

See forex today

European markets are higher, Eurostoxx +0.35, FTSE +0.7%, and Dax +0.1%.

US futures are slightly positive.

Online News Magazine Wall Street top news

US GDP is better than expected.

US ADP jobs figures were worse than expected.

Powell will speak at 1830 GMT.

Hormel (HRL) down on earnings. Sales were short of forecasts.

Petco (WOOF) up on earnings beat.

Crowdstrike (CRWD) down on Q4 guidance.

NetApp (NTAP) down on weak forecast.

Workday (WDAY) up on strong outlook and share buyback.

Online News Magazine Reuters top headlines

Royal Bank of Canada (RBC): The largest Canadian lender reported a modest drop in fourth-quarter profit, as bigger provisions for potential loan defaults and weaker underwriting activity overshadowed gains from higher interest rates.

Brookfield Asset Management: The Canadian asset manager will buy a 49% stake in the education portfolio of Sweden’s SBB, for 9.2 billion Swedish crowns in cash.

Foot Locker Inc (FL): The footwear retailer said on Tuesday finance chief Andrew Page will move out of his role to pursue other opportunities following the company’s fourth quarter 2022 earnings.

Horizon (HZNP) with a market capitalization of about $18 billion is in talks with Amgen, Sanofi and Johnson & Johnson unit Janssen Global Services.

Boeing (BA): A key US lawmaker is proposing an extension of a certification deadline for two new versions of Boeing’s 737 MAX.

Coterra Energy (CTRA) The US shale producer pleaded no contest for contaminating well water in Dimock, Pennsylvania, and will pay $16.29 million to construct a new means of water supply to its residents, the state attorney general said on Tuesday.

Walt Disney Co (DIS) said it anticipates organizational and operational changes in the company that could result in impairment charges, according to a regulatory filing.

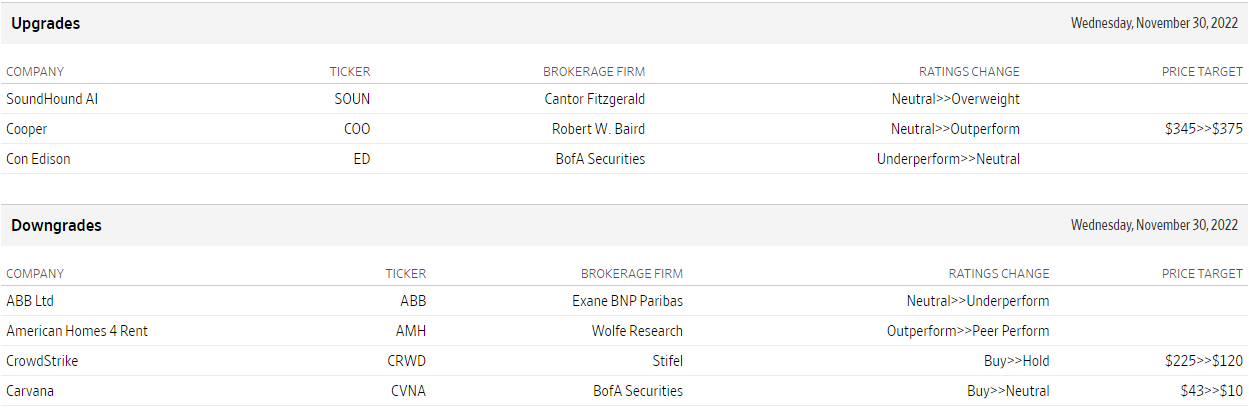

Upgrades and downgrades

Source: WSJ.com

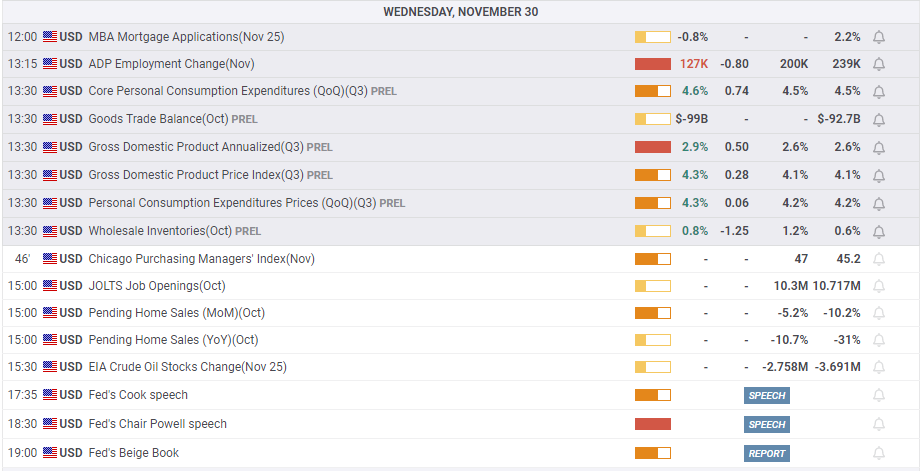

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

0 Comments :

Post a Comment